A Suffolk Driver's Guide to Misfuelling Insurance Cover

- Misfuelled Car Fixer

- Jan 28

- 13 min read

24/7 Hotline Nationwide: 0330 122 6640

National Wrong Fuel Rescue: https://www.misfuelledcarfixer.co.uk

If you found this page, we cover you!

You've just put the wrong fuel in your car. That horrible, sinking feeling hits you right in the pit of your stomach. It’s a simple, honest mistake, but one that can leave you stranded and facing a hefty bill.

This is precisely where misfuelling insurance cover steps in. Think of it as a specialised safety net, an add-on to your main motor insurance policy designed to cover the costs of sorting out this specific, messy problem.

That Sinking Feeling at the Petrol Pump

Picture it: you’re at a busy petrol station in Ipswich, maybe running late for a meeting or just lost in thought. For a split second, your mind wanders, and you grab the green nozzle instead of the black one. You only realise what you’ve done when it’s too late.

If this sounds familiar, you’re not alone. This moment of distraction is surprisingly common. In fact, a recent survey found that a staggering 29% of UK drivers have put the wrong fuel in their car at some point. That works out to between 355 and 410 incidents every single day. It’s a testament to how easily it can happen to anyone. For more insights, you can check out the full Go Compare report.

What Is Misfuelling Insurance Cover?

So, what exactly does this cover do? A lot of people mistakenly believe their standard comprehensive insurance will pick up the tab. In most cases, it won't. Misfuelling is often seen as a preventable error, not accidental damage, and is specifically excluded from many policies.

This is where misfuelling cover proves its worth. It’s essentially a dedicated breakdown service just for your fuel system.

Most policies will typically include:

Draining the wrong fuel from the tank.

Flushing the entire fuel system to clear out any residue.

A small amount of the correct fuel to get you on your way again.

Think of it this way: your standard policy covers you for crashes and theft, but it draws a line at mistakes like this. Misfuelling cover bridges that gap. Without it, you’re on your own, facing the full cost of an emergency fuel drain right out of your own pocket.

For drivers across Suffolk, whether you’re a daily commuter or a fleet manager responsible for multiple vehicles, knowing this can make all the difference. It's one of those small, affordable extras you hope you'll never need, but you'll be incredibly glad you have it if that moment of distraction ever strikes at the pump.

Getting to Grips with Your Misfuelling Insurance Policy

When you tick the box to add misfuelling cover to your motor insurance, you’re buying peace of mind. But what are you actually getting for your money? It pays to read the small print because, as with any insurance, the devil is very much in the detail.

Think of it this way: you can buy a basic first-aid kit with just a few plasters, or you can get a comprehensive one for tackling more serious situations. Misfuelling cover works in the same way. Some policies offer the bare minimum to get you out of a jam, while others provide much more robust protection. You need to know which one you have.

At its heart, misfuelling insurance is an emergency breakdown service for a very specific mistake. It's designed to fix the immediate problem – the wrong fuel in your tank – not to cover long-term engine damage that might result from it.

What’s Usually Covered?

Most solid misfuelling policies will include a core set of services to get your vehicle running again. If you find yourself in this situation, you can generally expect your cover to handle:

Draining the Wrong Fuel: A specialist will come to you, wherever you are, and safely drain the entire tank of the contaminated fuel.

Flushing the Fuel System: Once the tank is empty, they'll flush the fuel lines to clear out any residue. This is a crucial step to prevent the wrong fuel from making its way to your engine.

A Splash of the Right Stuff: The policy will almost always include a small top-up of the correct fuel, usually around 5-10 litres, which is more than enough to get you to the nearest petrol station.

These three steps are the bread and butter of misfuelling cover. They’re designed to solve the problem on the spot, assuming you’ve had the presence of mind not to start the engine.

Remember, this cover is all about getting you moving again. Its job is to fix the immediate fuel mix-up, not to pay for engine repairs if the damage has already been done.

What’s Often Left Out? Common Exclusions and Limits

This is where many drivers get caught short. While your policy will cover the essentials, it will almost certainly have a list of things it won't cover. Knowing these exclusions is just as important as knowing what's included.

The biggest one? Engine damage. If you turn the key and drive away with petrol in your diesel engine (or vice versa), any resulting damage to the fuel pump, injectors, or the engine itself is almost never covered. The insurance is there to prevent the damage, not to fix it once it's happened.

Here's a quick look at how the cover often breaks down.

Misfuelling Insurance Policy Features At A Glance

Covered Service | Typical Inclusion | Common Exclusion or Limitation |

|---|---|---|

Emergency Call-Out | 24/7 roadside assistance to your location. | May have limits on call-outs per year. |

Fuel Drain & Flush | Full draining of the tank and flushing of fuel lines. | Costs of disposing of the contaminated fuel might be extra. |

Correct Fuel Top-Up | Provides 5-10 litres of the correct fuel. | Anything more than the initial top-up is at your expense. |

Engine Damage Repair | Almost never included. | This is the most critical exclusion; repair costs fall to you. |

Replacement Parts | Not typically covered. | If filters or seals are damaged, you pay for the new parts. |

AdBlue Contamination | Often explicitly excluded from standard cover. | Requires specialist cleaning and is considered a separate issue. |

As you can see, the policy is designed for a very specific scenario. Be sure to look out for other common exclusions in your policy documents, such as:

Claim Limits: Some insurers will only let you claim once or twice a year for misfuelling.

Vehicle Restrictions: Your cover might not apply to very old vehicles or certain types of commercial vans.

AdBlue Mix-ups: Putting AdBlue into the diesel tank is a whole different (and often more corrosive) problem. Because of the specific damage it can cause, this is frequently excluded from standard misfuelling policies.

Choosing Between an Insurance Claim and a Specialist

You’re standing on the forecourt of a petrol station in Bury St Edmunds, that sinking feeling hitting you as you realise your mistake. The wrong fuel nozzle is still in your hand. After the initial panic, a very practical question follows: who do you call? Do you get on the phone to your insurance company, or should you call a specialist fuel drain service directly?

It’s a decision that can make a real difference to your wallet, your time, and even how much you pay for insurance next year. Getting it right in that stressful moment really comes down to understanding the pros and cons of each path. While an insurance claim might seem the obvious choice if you have misfuelling cover, it’s not always the simplest or cheapest option.

The Insurance Claim Route

Going down the insurance route means calling your provider, who will then usually arrange for one of their approved technicians to come out to you. For some, there’s a sense of security in dealing with a company you already know and trust.

But before you dial their number, it’s worth thinking about a few things:

Paying the Excess: You’ll almost certainly have to pay your policy excess, which could be anything from £50 to £250 or even more. If the total bill for the fuel drain isn't much higher than your excess, you could end up footing most of the cost yourself anyway.

Impact on Premiums: Any claim, no matter how small, gets logged on your insurance history. This could easily lead to a higher premium when it’s time to renew, costing you more over the long term.

Potential Delays: Going through a large insurance company can sometimes mean more red tape. You might find yourself waiting longer for an approved mechanic to be sent out, especially if it’s a busy time of day.

Using your insurance is a perfectly valid option, but it’s vital to weigh the short-term convenience against the potential for future costs and administrative delays.

The Specialist Service Route

The alternative is to skip the insurer altogether and call an emergency fuel drain specialist directly. It’s a pay-on-the-day service that brings a completely different set of advantages. For many drivers in Suffolk, this is the go-to solution.

Here’s why calling a specialist might be the smarter move:

No Insurance Impact: Because you're paying for the service out of your own pocket, there’s no claim to record. Your no-claims bonus is safe, and there’s zero risk of your premiums going up because of the incident.

Transparent Cost: A good specialist will give you a clear, all-in quote for the job right from the start. You won’t have to worry about hidden fees or an excess – the price you’re quoted is the price you pay.

Faster Response Times: Specialist services are geared for speed. They run 24/7 and usually have technicians positioned across Suffolk, which means they can often get to you far quicker than a contractor dispatched by an insurer.

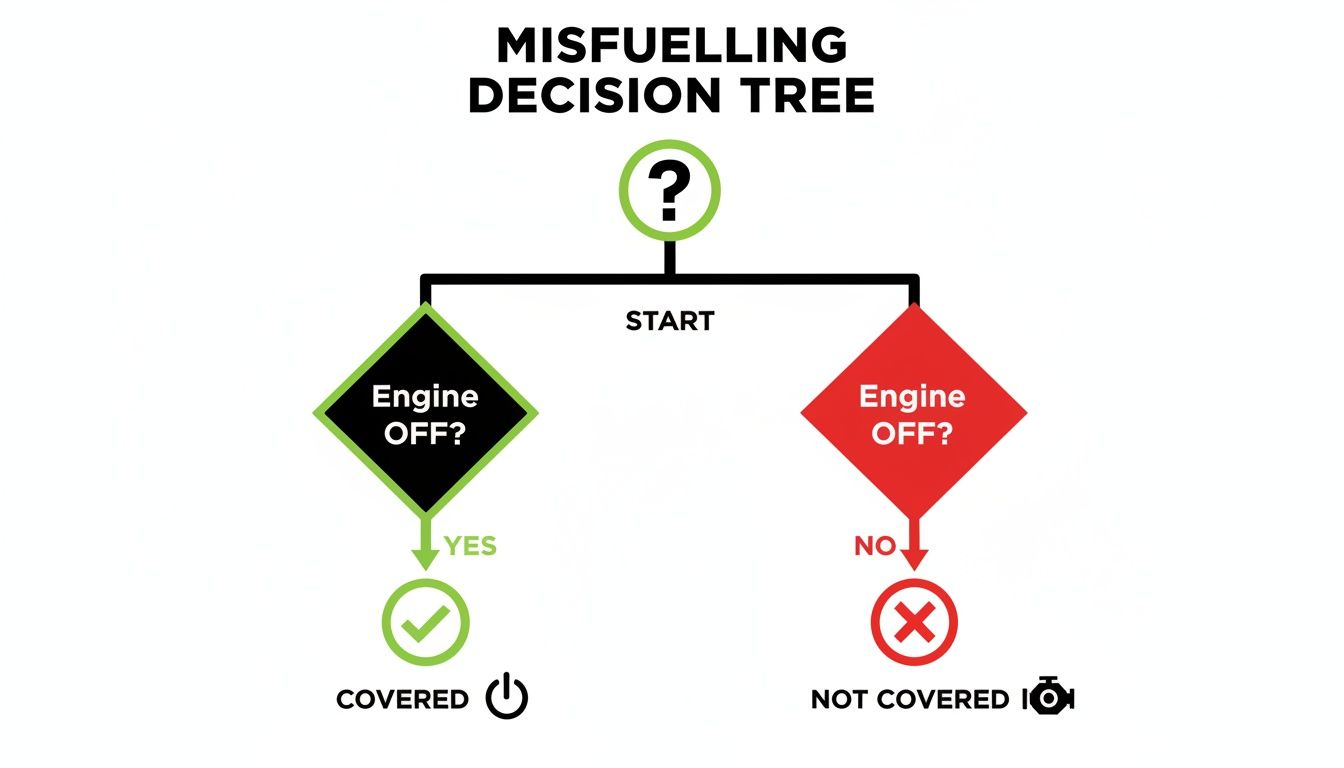

This decision tree highlights the single most important question your insurer will ask: did you start the engine?

As you can see, keeping that engine off is the best thing you can do to keep your insurance cover valid and, more importantly, avoid some seriously expensive mechanical damage.

At the end of the day, while misfuelling insurance cover is a good safety net to have, calling a specialist often proves to be a faster, more straightforward solution without any long-term financial sting. For a deeper dive into what to do, check out our complete Suffolk misfuelling guide. Making a calm, informed choice can save you a world of time, money, and hassle.

Navigating the Insurance Claims Process

So, you’ve discovered you have misfuelling cover and you need to use it. Making that call to your insurer can feel a bit stressful, but knowing what to expect turns a drama into a straightforward process. It’s a well-oiled machine designed to get you sorted and safely back on your way.

The moment you get in touch, your insurer kicks off a specific chain of events. Their first job is to check your policy details and get a specialist out to you, pronto. Having the right information to hand will make a world of difference.

Making That First Call

When you ring your insurance provider, they'll need a few key bits of information to get the ball rolling on your claim. A little preparation here can speed the whole thing up.

Try to have these details ready:

Your Policy Number: This is the magic number that lets them pull up your records and confirm your cover instantly.

Your Location: Be as precise as you can. Saying "the Tesco petrol station in Martlesham" is better than just "somewhere on the A12."

Vehicle Details: Your car's registration, make, and model are must-haves.

A Quick Summary: Just explain what's happened – which fuel you put in by mistake and, crucially, whether you started the engine.

Once they've confirmed everything, they’ll arrange for one of their approved mobile fuel drain specialists to come out to you. These are the pros they trust to handle these exact situations.

The single most important thing you can tell your insurer is whether you've turned the engine on. That one detail dictates everything that happens next and the complexity of the fix.

When the Recovery Technician Arrives

The specialist sent by your insurer will have everything they need to fix the problem right there at the roadside. The goal is to get it sorted without the hassle of towing your car to a garage.

Typically, the process involves draining the entire fuel tank, flushing the system to get rid of any lingering contamination, and then putting in a small amount of the correct fuel to get you to the nearest pump. This is usually when you'll need to pay your policy excess, often directly to the technician. Always ask for a receipt or an invoice for the work; it's vital for your records. Keeping a note of everything, from when you first called to when the job was finished, is just good practice and gives you a clear timeline of the claim.

Is Misfuelling Insurance Cover a Smart Buy for You?

Deciding whether to add misfuelling cover to your motor insurance often feels like a bit of a gamble. Do you pay a small, certain amount each year to avoid a potentially large, uncertain bill down the line? For some Suffolk motorists, it's a no-brainer for peace of mind. For others, it might just be money down the drain.

The truth is, there’s no one-size-fits-all answer. It all boils down to your driving habits, what you drive, and how comfortable you are with risk. Let's break it down so you can figure out what makes the most sense for you.

Analysing Your Driver Profile

To get a clearer picture, it helps to think about what kind of driver you are. Your chances of making this surprisingly common mistake can change dramatically depending on your daily routine.

See if any of these sound familiar:

The Careful Commuter: You drive the same car every day, probably on the same routes like the A14 into Ipswich. You know your vehicle like the back of your hand and filling up is pure muscle memory. For you, the risk is pretty low.

The Multi-Vehicle Household: The driveway has both a petrol and a diesel car. If you're constantly switching between them, especially when you’re rushed or distracted, the odds of a mix-up at the pump shoot right up.

The Fleet Manager: You oversee a fleet of vans buzzing around Felixstowe or Lowestoft. With different drivers hopping into various vehicles, it's almost a statistical certainty that a misfuelling incident will happen sooner or later.

The New or Rental Car User: You’re often behind the wheel of an unfamiliar hire car for work, or you've just bought a new car that takes a different fuel from your old one. This is prime time for a misfuelling mistake.

If you fit into the multi-vehicle, fleet, or new driver camp, that small annual premium for misfuelling insurance cover suddenly looks very sensible. It turns a potential crisis into a predictable, manageable cost.

A Quick Cost-Benefit Breakdown

At the end of the day, this decision really comes down to the numbers. You're weighing the yearly cost of an insurance add-on against the one-off hit of calling out a specialist fuel drain service if the worst happens.

Here’s a simple table to compare the two scenarios.

Cost Analysis: Insurance Add-On vs. Specialist Service

Cost Factor | Misfuelling Insurance Claim | Specialist Fuel Drain Service |

|---|---|---|

Upfront Cost | Annual premium (e.g., £20-£40) | £0 until needed |

Emergency Cost | Policy excess (e.g., £50-£250) | One-off fee (e.g., £150-£300+) |

Hidden Costs | Potential increase in future premiums | None |

Financial Model | Predictable, annual budgeting | Pay-as-you-go, only when required |

Looking at it this way, a careful solo driver might find it more economical over the long run to simply pay for a specialist if it ever happens. The odds are in their favour.

But for a business managing several vehicles, that annual premium is a smart operational expense. It protects them from a much larger, unexpected bill that could disrupt cash flow. To see a more detailed breakdown, our guide explores the full cost of putting the wrong fuel in your car.

Ultimately, buying misfuelling cover is a bit like placing a bet against yourself. You're paying a little something just in case you make a mistake. Whether that bet is worth it really depends on how likely you think you are to slip up at the pump.

Simple Habits to Prevent Misfuelling Your Car

While having misfuelling insurance offers a fantastic safety net, the best approach is always to avoid the mistake in the first place. You can save yourself a world of hassle and expense just by building a few straightforward habits into your fuelling routine.

It really just boils down to breaking out of autopilot mode. Before you even lift the nozzle from the pump, make a point to stop for a second and consciously double-check the fuel type. This tiny pause is especially important if you're driving a car you're not used to, like a hire car or a new company vehicle.

Building Your Prevention Routine

To help make checking second nature, here are a few practical tips that actually work:

Add a Reminder: A brightly coloured sticker on the inside of your fuel flap saying “DIESEL ONLY” or “PETROL ONLY” is a surprisingly effective visual nudge right when you need it most.

Check the Nozzle: Get into the habit of glancing at the nozzle's colour and the label on the trigger before you put it anywhere near your tank. Green for petrol, black for diesel – it’s a simple final check.

Minimise Distractions: Try to avoid chatting on the phone or getting lost in thought at the pump. That one moment of distraction is often all it takes to make this costly slip-up.

It's worth noting that many modern diesel cars now feature a built-in misfuelling prevention device. This clever bit of design physically stops the narrower petrol nozzle from fitting into the wider diesel filler neck, providing an excellent last line of defence.

Of course, for businesses running multiple vehicles, individual habits are only part of the solution. Many firms in Suffolk are now implementing comprehensive fleet fuel management systems to create standardised procedures and reduce risk across the board.

For an even deeper dive, take a look at our complete https://www.misfuelledcarfixer-suffolk.co.uk/post/wrong-fuel-in-a-car-fix-and-prevention-guide.

Got Questions About Misfuelling? We’ve Got Answers

Putting the wrong fuel in your car is a surprisingly common slip-up, and it’s natural to have a few urgent questions running through your mind. Here are some straightforward answers to what Suffolk drivers often ask us.

Will Misfuelling Invalidate My Car's Warranty?

In a word, no—but what you do next is absolutely crucial. The act of misfuelling itself won’t usually void your manufacturer’s warranty. The problem arises if you then drive the car.

Any engine damage that happens as a result of running on the wrong fuel almost certainly won't be covered by the warranty. That's why the golden rule is to never start the engine. By getting a professional to drain the tank, you sidestep the damage and keep your warranty intact.

Surely My Comprehensive Insurance Will Cover This?

You’d think so, but it's highly unlikely. The vast majority of standard car insurance policies, even the fully comprehensive ones, list misfuelling as a specific exclusion.

To get cover for the cost of a fuel drain, flush, and any potential repairs, you typically need to have bought a specific misfuelling insurance cover add-on. Don’t assume you're covered; it's always best to dig out your policy documents and check the fine print.

It's a common trap to think "comprehensive" covers every possible eventuality. In the world of insurance, policies are built on specifics, and misfuelling is a very common exclusion.

I've Already Started the Engine. Is the Damage Done?

Not necessarily, but you need to act fast. Pull over as soon as it’s safe to do so and switch off the ignition immediately.

The less time the engine is running, the less contaminated fuel gets pumped through the system. This minimises the risk of serious, wallet-draining damage. A specialist can still drain the tank and flush the system to prevent things from getting any worse.

If you've put the wrong fuel in your car in Ipswich, Bury St Edmunds, or anywhere across Suffolk, the first step is not to panic. The second is to call us. Misfuelled Car Fixer provides a rapid, 24/7 emergency fuel drain service. Get in touch right away, and we’ll get you back on the road safely.

Comments